14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to § |

SCP Pool Corporation

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No Fee Required

| x | No fee required. |

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1. | Title of each class of securities to which transaction applies: |

| 2. | Aggregate number of securities to which transaction applies: |

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. |

| 4. | Proposed maximum aggregate value of transaction: |

| 5. | Total |

¨ Fee paid previously with preliminary materials.

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box |

| 1. | Amount |

| 2. | Form, |

| 3. | Filing |

| 4. | Date |

SCP POOL CORPORATION

109 Northpark Boulevard, Suite 400

Covington, Louisiana 70433-5001

March 26, 2004

Dear Stockholder:

You are cordially invited to attend the 2004 annual meeting of stockholders of SCP Pool Corporation (the “Company”) to be held at the office of Jones, Walker, Waechter, Poitevent, Carrere & Denegre L.L.P., 201 St. Charles Avenue, New Orleans, Louisiana 70170-5100, on Thursday, May 6, 2004, at 9:00 a.m., Central Standard Time.

At this year’s meeting, you will vote on the election of the directors, approval of an amendment to the Company’s Amended Certificate of Incorporation to increase the number of authorized shares of the Company’s Common Stock from 40,000,000 to 100,000,000, approval of an amendment to the Company’s 2002 Long-Term Incentive Plan (the “2002 LTIP”) to increase the maximum number of shares of the Company’s Common Stock authorized for issuance thereunder from 1,050,000 to 1,800,000 shares, and the ratification of Ernst & Young LLP’s appointment as independent auditors. You will also consider and act upon such other matters as may properly come before the meeting.

Whether or not you expect to attend the meeting, it is very important that your shares are represented and it would therefore be helpful if you would return your signed and dated proxy in the envelope provided as soon as possible. This will ensure that your vote is counted.

This proxy statement and the accompanying proxy card are first being mailed on or about March 26, 2004, to stockholders of record as of March 12, 2004.

|

|

|

|

SCP POOL CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Stockholders of SCP Pool Corporation:

The annual meeting of stockholders of SCP Pool Corporation (the “Company”) will be held at the office of Jones, Walker, Waechter, Poitevent, CarrereCarrère & DenegreDenègre, L.L.P., at 201 St. Charles Avenue, New Orleans, Louisiana 70170-5100, on Thursday,Tuesday, May 6, 2004,10, 2005, at 9:00 a.m., Central Standard Time, for the following purposes:

| 1. | To elect eight persons to serve as directors on the Company’s Board of Directors for a one-year term or until their successors have been elected and qualified; |

| 2. | To |

| To act upon such other matters as may properly come before the meeting or any reconvened meeting following any adjournment thereof. |

The foregoing items are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has set March 12, 2004,14, 2005, as the record date for the meeting. This means that only record owners of the Company’s Common Stock at the close of business on that date are entitled to notice of, and to vote at, the annual meeting and at any adjournment or postponement thereof.

By Order of the Board of Directors, |

/s/ |

|

Covington, Louisiana

March 26, 200428, 2005

WEURGEEACHSTOCKHOLDERTOPROMPTLYSIGNANDRETURNTHEENCLOSEDPROXYCARDOR,IFAPPLICABLEAVAILABLE,TOUSETELEPHONEOR INTERNETVOTING. SEE “V“OTINGVOTING PROCEDURES”FORINFORMATIONABOUTVOTINGBYTELEPHONEOR INTERNET.

SCP POOL CORPORATION

109 Northpark Boulevard, Suite 400

Covington, Louisiana 70433-5001

PROXY STATEMENT

We are furnishing this Proxy Statement to our stockholders in connection with the solicitation of proxies by and on behalf of the Board of Directors (the “Board of Directors” or the “Board”) of SCP Pool Corporation (the “Company”) for use at the 20042005 annual meeting of our stockholders to be held on May 6, 2004,10, 2005, at 9:00 a.m., Central Standard Time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders (the “Meeting”). The Meeting will be held at the office of Jones, Walker, Waechter, Poitevent, CarrereCarrère & DenegreDenègre, L.L.P., 201 St. Charles Avenue, New Orleans, Louisiana 70170-5100. This Proxy Statement is first being mailed to stockholders on or about March 26, 2004.28, 2005.

Voting Procedures

Only holders of record of the Company’s common stock, $0.001 par value per share (“Common Stock”), at the close of business on March 12, 2004,14, 2005, are entitled to notice of and to vote at the Meeting. On March 12, 2004,14, 2005, we had outstanding 35,501,82952,458,373 shares of Common Stock, each of which is entitled to one vote.

The holders of a majority of the shares of Common Stock issued and outstanding, present in person or represented by proxy, will constitute a quorum at the Meeting. If a quorum is present, (1) directors will be elected by a plurality vote; (2) the proposed amendment to the Company’s Amended Certificate of Incorporation will require the affirmative vote of the holders of a majority of the outstanding shares of Common Stock; and (3) the proposed amendment to the Company’s 2002 Long-Term Incentive Plan (the “2002 LTIP”) and(2) the ratification of the retention of the independent auditors will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or by proxy at the Meeting.

Management does not know of any items, other than those referred to in the accompanying Notice of Annual Meeting of Stockholders, whichthat may properly come before the Meeting or other matters incident to the conduct of the Meeting. If, however, any other matters properly come before the Meeting, the persons named as proxies in the enclosed form of proxy intend to vote in accordance with their judgment on the matters presented.

Abstentions will be treated as present both for purposes of determining a quorum and with respect to each proposal other than the electionratification of directors. If brokers do not receive instructions from beneficial owners as to the granting or withholding of proxies, and may not or do not exercise discretionary power to grant a proxy with respect to such shares (a “broker non-vote”), then shares not voted on such proposal, other than the election of directors, will be counted as not present and not cast with respect to such proposal.independent directors. Accordingly, abstentions will have no effect on the election of directors, but will have the effect of a vote against the other proposals,ratification of the independent auditors.

A “broker non-vote” occurs when a nominee (such as a broker or bank) holding shares in “street name” as the registered holder for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to the matter and has not received voting instructions from the beneficial owner. Broker non-votes will be treated as not present and not cast for purposes of determining a quorum and with respect to all matters brought before the Meeting. Accordingly, broker non-votes will have no effect on the election of directors or the ratification of the independent auditors, or the amendment to the Company’s 2002 LTIP, but will have the effect of a vote against the amendment to the Company’s Amended Certificate of Incorporation.auditors.

If you come to the Meeting, you can, of course, vote in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Meeting, you must obtain from the record holder a proxy issued in your name. If you do not come to the Meeting, your shares can be voted only if you have returned a properly executed proxy. If you hold your shares through a bank, broker, or other nominee, you must provide voting instructions to the bank, broker, or nominee; obtain a proxy issued in your name from such record holder; or if your bank, broker, or nominee makes telephone or Internetinternet voting available, follow the internet or telephone voting instructions the bank, broker or nominee will enclose with thethis proxy statement.

If you execute and return your proxy but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors. You can revoke your authorization at any time before the shares are voted at the Meeting by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. TheYour proxy will also be deemed revoked with respect to any matter on which you vote in person at the Meeting. Attendance at the Meeting will not in and of itself constitute a revocation of a proxy. Unless otherwise marked, properly executed proxies in the form of the accompanying proxy card will be voted in favor of the election of each of the nominees approval of the proposed amendment to the Company’s Amended Certificate of Incorporation, approval of the proposed amendment to the Company’s 2002 LTIP, and the ratification of the independent auditors.

1

Solicitation

The Company will bear the entire cost of soliciting proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Banks, brokerage houses and other nominees or fiduciaries will be requested to forward the soliciting materials to their principals and to obtain authorization for the execution of proxies. The Company will, upon request, reimburse them for their expenses in so acting. Certain employees of the Company, who will receive no additional compensation for their services, may also solicit proxies by telephone, facsimile or electronic mail.

ELECTION OF DIRECTORS

(Proposal 1)

General

The Company’s By-laws, as amended, provide that the size of the Board shall be fixed from time to time by resolution of the Board and that vacancies on the Board may be filled by a majority of the directors then in office. On February 10, 2004, the Board unanimously approved a resolution authorizing an increase in the number of directors from seven to eight. Presently, seven directors serve on the Board.

At the Meeting, eight directors are to be elected to one-year terms, each to hold office until his successor is elected and has qualified. Unless authority to vote for the election of directors is withheld by appropriate designation on the proxy, the proxies solicited hereby will be voted FOR the election of each nominee. If any nominee should decline or be unable to serve for any reason, votes will instead be cast for a substitute nominee designated by the Board. The Board has no reason to believe that any nominee will decline to be a candidate or, if elected, will be unable or unwilling to serve. Under the Company’s By-laws, as amended, directors are elected by plurality vote.

Information about the Company’s Directors and Nominees

The following information sets forth, as of February 20, 2004,21, 2005, certain information about the Company’s directors, and nominees all of whom have been nominated for election to the Board. Unless otherwise indicated, each person has been engaged in the principal occupation shown for the past five years.

| WILSON B. SEXTON | Director since 1993 | |

Covington, Louisiana | Age | |

Mr. Sexton has been the Chairman of the Board and a director of the Company since 1993. From May 2001 to the present, Mr. Sexton has remained employed by the Company primarily in the area of investor relations. From January 1999 to May 2001, Mr. Sexton served as Chief Executive Officer of the Company. Presently, Mr. Sexton also serves as a director of Beacon Roofing Supply, Inc.

Mr. Sexton has been the Chairman of the Board and a director of the Company since 1993. From May 2001 to the present, Mr. Sexton has remained employed by the Company primarily in the area of investor relations. From January 1999 to May 2001, Mr. Sexton served as Chief Executive Officer of the Company.

ANDREW W. CODE | Director since 1993 | ||

Chicago, Illinois | Age | ||

Mr. Code has been a general partner of CHS Management Limited Partnership (“CHS Management”) and a general partner of Code, Hennessy & Simmons Limited Partnership (“CHS”) since August 1988.

Chairman of the Compensation Committee of the Board of Directors of the Company.

JAMES J. GAFFNEY | Director since 1998 | ||

Los Angeles, California | Age | ||

From 1997 through 2003, Mr. Gaffney served as Vice Chairman of the Board of Viking Pacific Holdings, Ltd. and Chairman of the Board of Vermont Investments, Ltd., a New Zealand-based conglomerate, and provided consulting services to GS Capital Partners II, L.P. (a private investment fund affiliated with Water Street Corporate Recovery Fund I, L.P. and Goldman, Sachs & Co.), and other affiliated investment funds. Mr. Gaffney presently serves as Chairman of the Board of Directors of Imperial Sugar Company and as a director of Hexcel Incorporated.

Chairman of the Nominating and Corporate Governance Committee and member of the Audit Committee and member of the Audit and Compensation Committees of the Board of Directors of the Company.

2

| GEORGE T. HAYMAKER, JR. | Director since 2004 | |

| San Francisco, California | Age 67 | |

| Mr. Haymaker is Chairman of the Board of Kaiser Aluminum Corporation (“Kaiser”), having served in that position since October 2001. He was also Chief Executive Officer of Kaiser from January 1994 until his retirement in December 1999. Mr. Haymaker also presently serves as a director of Flowserve Corporation and Hayes Lemmerz International, Inc. | ||

Member of the Compensation Committee of the Board of Directors of the Company. | ||

| MANUEL J. PEREZDELA MESA | Director since 2001 | |

Covington, Louisiana | Age 47 | |

Mr. Perez de la Mesa has been Chief Executive Officer of the Company since May 2001 and has also been the President of the Company since February 1999. Mr. Perez de la Mesa served as Chief Operating Officer of the Company from February 1999 to May 2001. Mr. Perez de la Mesa is also a director of American Reprographics Company.

Mr. Perez de la Mesa has been Chief Executive Officer of the Company since May 2001 and has also been the President of the Company since February 1999. Mr. Perez de la Mesa served as Chief Operating Officer of the Company from February 1999 to May 2001. Prior to joining the Company, Mr. Perez de la Mesa served as Vice President, Distribution Operations for Watsco, Inc., a HVAC/R distribution company, from 1996 to January 1999.

| HARLAN F. SEYMOUR | Director since 2003 | ||

| Glen Allen, Virginia | Age 55 | ||

| Mr. Seymour has conducted personal investments and business advisory services through HFS LLC, of which he is the sole executive officer, since March 2001. From June 2000 through March 2001, he served as Executive Vice President of ENVOY Corporation, which became a wholly-owned subsidiary of Quintiles Transnational Corp. in March 1999. From March 1999 to June 2000, he served as an independent consultant to ENVOY Corporation. Mr. Seymour also presently serves as Chairman of the Board of Transaction Systems Architects, Inc. | |||

Member of the Audit Committee and the Nominating and Corporate Governance Committee of the Board of Directors of the Company. | |||

| ROBERT C. SLEDD | Director since 1996 | ||

Richmond, Virginia | Age | ||

Mr. Sledd has served as Chairman of the Board of Directors of Performance Food Group Company (“PFG”) since February 1995 and has served as a director of that company since 1987. Mr. Sledd served as Chief Executive Officer of PFG from 1987 to 2001. Mr. Sledd is also a director of Union Bankshares Holding Co.

Member of the Audit Committee and the Compensation Committee of the Board of Directors of the Company.

JOHN E. STOKELY | Director since 2000 | ||

Glen Allen, Virginia | Age | ||

Mr. Stokely has served as President of JES, Inc., an investment and consulting firm, since August 1999. From January 1997 to August 1999, Mr. Stokely was the President, Chief Executive Officer and Chairman of the Board of Directors of Richfood Holdings, Inc., a food retailer and wholesale grocery distributor that merged with Supervalu, Inc. in August 1999. Mr. Stokely is also a director of PFG, Nash Finch Company, and Transaction Systems Architects, Inc.

Chairman of the Audit Committee and member of the Nominating and Corporate Governance Committee of the Board of Directors of the Company.

| Mr. Stokely has served as President of JES, Inc., an investment and consulting firm, since August 1999. From January 1997 to August 1999, Mr. Stokely was the President, Chief Executive Officer and Chairman of the Board of Directors of Richfood Holdings, Inc., a food retailer and wholesale grocery distributor that merged with Supervalu, Inc. in August 1999. Mr. Stokely is also a director of PFG, O’Charleys, Inc. and Transaction Systems Architects, Inc. | ||||

| Lead Independent Director, | |||

| ||||

Mr. Seymour has conducted personal investments and business advisory services through HFS LLC, of which he serves as sole executive officer, since March 31, 2001. From June 2000 through March 2001, he served as Executive Vice President of ENVOY Corporation, which became a wholly-owned subsidiary of Quintiles Transnational Corp. in March 1999. From March 1999 to June 2000, he served as an independent consultant to ENVOY Corporation. From July 1997 to March 1999, he served as Senior Vice President of ENVOY Corporation and also served on that company’s Board of Directors. Mr. Seymour also presently serves as Chairman of the Board of Transaction Systems Architects, Inc.

Member of the Audit Committee and member of the Nominating and Corporate Governance Committee of the Board of Directors of the Company.

| ||

|

Mr. Haymaker is Chairman of the Board of Kaiser Aluminum Corporation (“Kaiser”), having served in that position since October 2001. He was also Chief Executive Officer of Kaiser from January 1994 until his retirement in December 1999. Mr. Haymaker also presently serves as a director of Flowserve Corporation and Hayes Lemmerz International, Inc.

The Board of Directors unanimously recommends that the Company’s stockholders vote “FOR” the election of the nominees.

3

Information about Executive Officers

The following information sets forth, as of February 20, 2004,21, 2005, certain information about the Company’s 20032004 executive officers, all of whom are expected to remain in their current positions following the Meeting.

| A. DAVID COOK | Age | |

Mr. Cook has served as Vice President of the Company since February 1997. From

Mr. Cook has served as a Vice President of the Company since February 1997 and from December 1993 until February 1997, he served as the Director of National Sales Development for the Company’s principal operating subsidiary.

| Age | ||

Mr. Joslin has served as Vice President, Chief Financial Officer of the Company since August 2004. From December 2002 until August 2004, he served as Vice President of Corporate Development for Eastman Chemical Company. From October 1999 to December 2002, he held the position of Vice President and Corporate Controller for Eastman. Prior to October 1999, Mr. Joslin was employed as the Chief Financial Officer, Treasurer and Secretary of Lawter International.

Mr. Hubbard has served as Chief Financial Officer, Treasurer and Secretary of the Company since February 1997. From December 1993 until February 1997, he served as Controller for the Company’s principal operating subsidiary.

| |||

Mr. Meyer has served as Corporate Controller, Assistant Secretary and Assistant Treasurer since February 2002. Prior to that, he served as Controller from December 1997 until February 2002 and Assistant Controller from August 1995 until December 1997.

JOHN M. MURPHY | Age |

Mr. Murphy has served as Vice President of the Company since February 1997. From

Mr. Murphy has served as a Vice President of the Company since February 1997 and from December 1993 until February 1997, Mr. Murphy served as Director of Marketing for the Company’s principal operating subsidiary.

STEPHEN C. NELSON | Age | ||

Mr. Nelson has served as a Vice President of the Company since May 2002 and as General Manager since June 1998.

Mr. Nelson has served as Vice President of the Company since May 2002. He has also served as a General Manager since June 1998. From 1996 until 1998, Mr. Nelson was the Senior Business Consultant–Supply Chain Management for General Electric Information Services.

RICHARD P. POLIZZOTTO | Age | ||

Mr. Polizzotto has served as Vice President of the Company since May 1995. He has also served as Vice President of the Company’s principal operating subsidiary since December 1993.

CHRISTOPHER W. WILSON | Age | ||

| Mr. Wilson has served as Vice President of the Company since May 2002 and as General Manager since March 1998. | |||

Mr. Wilson has served as Vice President of the Company since May 2002. He has also served as a General Manager since March 1998. From 1976 until 1998, Mr. Wilson was the General Manager for Genuine Parts Company - Los Angeles, California.

4

Other Information About Theabout the Board Ofof Directors And Itsand its Committees

The Board of Directors met five timesheld seven meetings during 2003.2004. During the last full fiscal year, each director attended 75% or more of the total number ofBoard meetings, except Mr. Code, who attended five of the Board, andseven meetings. During 2004, each director attended 75% or more of the total number of meetings held by all committees of the Board on which he served. The Board has determined that each member of the Board, other than Messrs. Perez de la Mesa and Sexton, meets the definition of “independent director” as defined by Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. (“NASD”). MrMr. Stokely has been designated by the Board as its lead independent director and as such, Mr. Stokely will preside at any meetings of the Board’s independent directors and perform such other functions as the Board may direct, including recommending agenda items for Board meetings.

In 2003,2004, each non-employee director was paid an annual retainer of $8,000. Prior to August 6, 2003, eachEach non-employee director also received an attendance fee of $2,000 for each Board meeting attended, $1,000 for each committee meeting attended, except that the chairman of the audit committee received an attendance fee of $2,000 for each committee meeting attended, and $500 for each scheduled telephone meeting attended. Commencing on August 6, 2003, the Board authorized and approved the payment to each non-employee director an attendance fee of $4,000 for each Board meeting attended, $2,000 for each committee meeting attended, except that the chair of each committee receives an attendance fee of $4,000 for each committee meeting attended, and $1,000 for each scheduled telephone meeting attended. All directors are reimbursed for reasonable out-of-pocket expenses incurred in attending Board and committee meetings.

Under the SCP Pool Corporation 1996 Non-Employee Directors Equity Incentive Plan, as amended and restated (the “Director’s Plan”), upon election and each year thereafter, each non-employee director is granted an option to purchase 8,500 shares of Common Stock. OptionsExcept under certain limited circumstances, no options granted pursuant to the Director’s Plan become exercisable after completion ofearlier than one year after the date of service as a director.grant. The option price per share of Common Stock under the Director’s Plan is equal to 100% of the fair market value of the Common Stock at the date of grant. Each option granted under the Director’s Plan is exercisable for ten years after the date of grant. Non-employee directors may elect to receive additional shares of Common Stock under the Director’s Plan in lieu of the cash compensation otherwise due them.

Stockholders may communicate with members of the Company’s Board by mail addressed to the full Board, a specific member of the Board or to a particular committee of the Board at 109 Northpark Boulevard, Suite 400, Covington, Louisiana 70433.

The Company encourages each member of its Board of Directors to attend the Annual Meeting of the Company’s Stockholders. All of the Company’s directors attended the 2004 Annual Meeting.

The Company has adopted a Code of Business Conduct and Ethics that applies to the Company’s employees, officers (including the Company’s principal executive officer and principal financial officer) and directors. The Company’s Code of Business Conduct and Ethics is posted on the Company’s website at www.scppool.comwww.poolcorp.com and can also be obtained free of charge by sending a request to the Company’s Corporate Secretary at 109 Northpark Boulevard, Suite 400, Covington, Louisiana 70433.

The Board presently has an Audit committee,Committee, a Compensation committee,Committee and a Nominating and Corporate Governance Committee described as follows:

Audit Committee. The Audit Committee assists the Board in monitoring (1) management’s process for ensuring the integrity of the financial statements of the Company, (2) the independent auditor’s qualifications and independence, (3) the performance of the Company’s internal audit function and independent auditors and (4) management’s process for ensuring the Company’s compliance with legal and regulatory requirements. The Audit Committee’s specific responsibilities are set forth in its written charter, a copy of which is included as Appendix A. The Board of Directors has determined that each member of the Audit Committee meets the definition of an “independent director” as defined by theapplicable Securities and Exchange Commission (“SEC”) rules and NASD Rules 4200(a)(15) and 4350(d)(2)(A), and that Messrs. Stokely, Gaffney and Sledd qualify as “financial“audit committee financial experts” as defined by the SEC rulemaking and NASD Rule 4350(d)(2)(A). During 2003,2004, the Audit Committee held five meetings in person and three meetings via telephone conference.eleven meetings.

Compensation Committee. The Compensation Committee makes recommendations to the Board regarding the compensation of officers of the Company, the awards under the Company’s compensation and benefit plans and the Company’s compensation policies and practices. The Compensation Committee’s specific responsibilities are set forth in its written charter, a copy of which is included as Appendix B. The Board of Directors has determined that each member of the Compensation Committee meets the definition of an “independent director” as defined by NASD Rule 4200(a)(15). The Compensation Committee met one timetwo times during 2003.2004.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee’s primary purpose is to provide oversight on a broad range of issues surrounding the composition of the Board, including identifying individuals qualified to become Board members, recommending to the Board director nominees for the next

5

annual meeting of stockholders, and assisting the Board in the areas of committee member selection, evaluation of the overall effectiveness of the Board and committees of the Board, and review and consideration of corporate governance practices. The Nominating and Corporate Governance Committee has the authority to recommend to the Board candidates for Board membership. Stockholders may also make recommendations for director nominations by sending a letter to the

5

Nominating and Corporate Governance Committee in care of the Company’s address, or may make a nomination by complying with the notice procedures set forth in the Company’s By-laws, as amended. The specific responsibilities of the Nominating and Corporate Governance Committee are set forth in its written charter, a copy of which is included as Appendix C. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee meets the definition of an “independent director” as defined by NASD Rule 4200(a)(15). The Nominating and Corporate Governance Committee met one timetwo times during 2003.2004.

When identifying, evaluating and considering potential candidates for membership on the Company’s Board, including those recommended or nominated by stockholders, the Nominating and Corporate Governance Committee considers relevant educational, business and industry experience and demonstrated character and judgment. The Nominating and Corporate Governance Committee also considers such things as whether the nominee is independent for Nasdaq purposes and for incumbent directors whose terms are set to expire, the director’s overall service to the Company during his term, including the number of meetings attended, level of participation and quality of performance.

PRINCIPAL STOCKHOLDERS

The following table sets forth, as of February 20, 2004,21, 2005 (except as otherwise indicated), certain information regarding beneficial ownership of Common Stock by (i) each of the Named Executive Officers (as defined below in “Executive Compensation”), (ii) each director and nominee of the Company, (iii) all of the Company’s directors and executive officers as a group and (iv) each stockholder known by the Company to be the beneficial owner of more than 5% of the outstanding Common Stock, all as in accordance with Rule 13d-3 under the Securities Exchange Act of 1934 (the “Exchange Act”). Based on information furnished to the Company by such stockholders, unless otherwise indicated, all shares indicated as beneficially owned are held with sole voting and investment power.

Name of Beneficial Owner | Number of Shares Beneficially Owned (1) | Percentage of Outstanding | ||||

Wilson B. Sexton | (2) | % | ||||

Andrew W. Code | (3) | * | ||||

James J. Gaffney | (4) | * | ||||

George T. Haymaker, Jr. | — | * | ||||

Manuel J. Perez de la Mesa | (5) | % | ||||

Harlan F. Seymour | 19,125 | (6) | * | |||

Robert C. Sledd | * | |||||

John E. Stokely | ||||||

| ||||||

| * | |||||

A. David Cook | * | |||||

John M. Murphy | * | |||||

| * | |||||

Christopher W. Wilson | (12) | * | ||||

| ||||||

| ||||||

| (13) | % | ||||

TimesSquare Capital Management, Inc. | (14) | % | ||||

| (15) | % | ||||

All executive officers and directors as a group (14 persons) | (16) | % | ||||

| * | Less than one percent. |

| 1. | Shares reflect the 3-for-2 stock split effected in September |

| 2. | Includes (i) |

6

| 3. | Includes (i) |

| 4. | Includes |

| 5. | Includes |

| 6. | Includes |

| 7. | Includes 180,848 shares that Mr. Sledd has the right to acquire upon the exercise of presently exercisable options. Also includes |

| Includes |

| Includes |

| Includes |

| Includes |

| 12. | Includes 44,297 shares that Mr. Wilson has the right to acquire upon the exercise of presently exercisable |

| 13. | Based upon such holder’s Schedule 13G/A filed with the SEC on February 11, |

| 14. | Based upon such holder’s Schedule 13G/A filed with the SEC on February |

| 15. | Based upon such holder’s Schedule 13G/A filed with the SEC on February |

| 16. | Includes |

7

EQUITY COMPENSATION PLAN INFORMATION

For a complete description of the Company’s equity compensation plans, see Note 11 to the Company’s 2004 Annual Report on Form 10-K, which is incorporated herein by reference.

The following table provides information about shares of Common Stock that may be issued upon the exercise of options under all of the Company’s existing equity compensation plans as of December 31, 2004.

Plan Category | Number of shares of of outstanding options | Weighted-average exercise price of outstanding options ($) | Number of shares of Common Stock remaining available for future issuance under equity compensation plans | |||

Equity compensation plans approved by stockholders | 7,474,859 | 7.91 | 1,406,661 | |||

Equity compensation plans not approved to stockholders | — | — | — | |||

TOTAL | 7,474,859 | 7.91 | 1,406,661 | |||

EXECUTIVE COMPENSATION

The following table sets forth all cashthe compensation and options grantedpaid for each of the three years ended December 31, 2003,2004, December 31, 2002,2003, and December 31, 2001,2002, to the Company’s Chief Executive Officer and each of its four other most highly compensated executive officers (collectively, the “Named Executive Officers”).

| Annual Compensation |

Compensation Awards | All Other Compensation | ||||||||||||||||||

Name and Principal Position | Year | Salary | Bonus | Other Annual Compensation | Awards(1) | No. of Shares Underlying Options Granted(2) | ||||||||||||||

Manuel J. Perez de la Mesa President and Chief Executive Officer | 2004 2003 2002 | 347,752 304,596 289,654 | 335,000 255,000 246,000 | (3) | — — — | 8,113 7,405 | (5) (6) | |||||||||||||

A. David Cook Vice President | 2004 2003 2002 | 193,465 179,731 169,769 | 190,000 169,200 133,450 | 162,525 — — | 7,453 7,405 | (8) (6) | ||||||||||||||

John M. Murphy Vice President | 2004 2003 2002 | 196,899 179,731 169,769 | 190,000 168,300 144,500 | 162,525 — — | 8,113 7,405 | (5) (6) | ||||||||||||||

Vice President | 2004 2003 2002 | 151,431 139,793 132,155 | 146,000 98,000 101,077 | 65,010 — — | 7,453 | (8) (9) | ||||||||||||||

Christopher W. Wilson Vice President | 2004 2003 2002 | 168,283 159,508 146,994 | 162,000 142,450 135,828 | 65,010 — — | 7,453 6,540 | (8) (9) | ||||||||||||||

| 1. | As of December 31, 2004, based on the $31.90 market value per share of the Common Stock of such date (a) Mr. Cook held 7,500 shares of restricted stock, the aggregate value of which was $239,250; (b) Mr. Murphy held 7,500 shares of restricted stock, the aggregate value of which was $239,250; (c) Mr. Nelson held 3,000 shares of restricted stock, the aggregate value of which was $95,700; and (d) Mr. Wilson held 3,000 shares of restricted stock, the aggregate value of which was $95,700. Dividends are paid on the restricted stock at the same rate and at the same time as paid to all stockholders. |

| 2. | All shares have been adjusted |

8

| 3. | On May 6, 2004, the Compensation Committee authorized the reimbursement of certain federal taxes of Mr. Perez de la Mesa resulting from Mr. Perez de la Mesa’s exercise of certain stock options granted to him in 1999 and 2000. This tax liability was created by the Company’s revision to Mr. Perez de la Mesa’s original employment agreement prior to Mr. Perez de la Mesa’s commencement of employment with the Company wherein the Company decided to substitute stock options with a $0.01 exercise price for an equal number of restricted shares. While the substantive value of this change is insignificant, the tax consequences resulting from the change were determined to be adverse to Mr. Perez de la Mesa and beneficial to the Company. Since such change in tax consequences was not intended, the Compensation Committee authorized the reimbursement of the net additional tax consequences plus associated interest to Mr. Perez de la Mesa. The amount paid in 2004, which includes a gross-up for the taxes due, was $1,140,219. The Company estimates that it will receive tax deductions resulting in a cash benefit of approximately $510,000 from its more beneficial treatment. |

| Consists of the following contributions: $2,473 life, health and long-term disability insurance premiums and $11,309 contributed under the Company’s 401(k) plan. |

| 5. | Consists of the following contributions: $2,113 life, health and long-term disability insurance premiums and $6,000 contributed under the Company’s 401(k) plan. |

| Consists of the following contributions: $1,619 life, health and long-term disability insurance premiums, $286 paid under the Company’s profit sharing program and $5,500 contributed under the Company’s 401(k) plan. |

| 7. | Consists of the following contributions: $1,693 life, health and long-term disability insurance premiums and $11,309 contributed under the Company’s 401(k) plan. |

| 8. | Consists of the following contributions: $1,453 life, health and long-term disability insurance premiums and $6,000 contributed under the Company’s 401(k) plan. |

| 9. | Consists of the following contributions: $754 life, health and long-term disability insurance premiums, $286 paid under the Company’s profit sharing program and $5,500 contributed under the Company’s 401(k) plan. |

The following table sets forth information with respect to the Named Executive Officers concerning options granted during 2003.2004.

OPTION GRANTS IN LAST FISCAL YEAR

| Individual Grants (1) | Individual Grants (1) | ||||||||||||||||||||||||||

Name | No. of Shares Underlying Options Granted | % of Total Options Granted to Employees In 2003 | ($) Exercise | Expiration Date | ($) Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term | No. of Shares Underlying Options Granted | % of Total Options Granted to Employees In 2004 | ($) Exercise or Base Price | Expiration Date | ($) Potential Realizable Annual Rates of Stock Price Appreciation for Option Term | |||||||||||||||||

| 5% | 10% | 5% | 10% | ||||||||||||||||||||||||

Manuel J. Perez de la Mesa | 60,000 | (2) | 10.1 | % | 17.97 | 2/11/13 | 678,418 | 1,720,866 | 75,000 | (2) | 12.2 | 21.67 | 2/9/14 | 1,022,800 | 2,594,421 | ||||||||||||

A. David Cook | 22,500 | (3) | 3.8 | % | 17.97 | 2/11/13 | 254,407 | 645,325 | 15,000 | (3) | 2.4 | 21.67 | 2/9/14 | 204,560 | 518,884 | ||||||||||||

John M. Murphy | 22,500 | (3) | 3.8 | % | 17.97 | 2/11/13 | 254,407 | 645,325 | 15,000 | (3) | 2.4 | 21.67 | 2/9/14 | 204,560 | 518,884 | ||||||||||||

Richard P. Polizzotto | 18,000 | (3) | 3.0 | % | 17.97 | 2/11/13 | 203,525 | 516,260 | |||||||||||||||||||

Stephen C. Nelson | 6,000 | (3) | 1.0 | 21.67 | 2/9/14 | 81,824 | 207,554 | ||||||||||||||||||||

Christopher W. Wilson | 9,000 | (2) | 1.5 | % | 17.97 | 2/11/13 | 101,763 | 258,130 | 6,000 | (3) | 1.0 | 21.67 | 2/9/14 | 81,824 | 207,554 | ||||||||||||

| 1. | All options will vest immediately upon a change of control of the Company. |

| 2. | Options fully vest on February |

| 3. | Options vest in one-half increments on February |

89

The following table sets forth information with respect to the Named Executive Officers concerning option exercises during the fiscal year ended December 31, 20032004, and unexercised options held as of December 31, 2003.2004.

AGGREGATE OPTION EXERCISES IN LAST FISCAL YEAR AND

AGGREGATE OPTION VALUES AS OF DECEMBER 31, 20032004

| Number of Securities Underlying Unexercised Options at Year End | Value of Unexercised In-the- Money Options at Year End | |||||||||||||||||||||||

Name | Shares Acquired on Exercise | ($) Value | Number of Securities Underlying Unexercised Options at Year End | Value of Unexercised In-the- Money Options at Year End | ||||||||||||||||||||

| Shares Acquired on Exercise | ($) Value | Exercisable | Unexercisable | ($) Exercisable | ($) Unexercisable | Exercisable | Unexercisable | ($) Exercisable | ($) Unexercisable | |||||||||||||||

Manuel J. Perez de la Mesa | 40,500 | 746,429 | — | 666,750 | — | 15,492,983 | 60,750 | 1,382,670 | 253,125 | 761,250 | 7,406,438 | 17,030,588 | ||||||||||||

A. David Cook | — | — | 54,844 | 116,719 | 1,505,509 | 2,485,709 | — | — | 127,828 | 144,516 | 3,613,888 | 3,133,379 | ||||||||||||

John M. Murphy | — | — | 21,094 | 116,719 | 536,209 | 2,485,712 | — | — | 77,203 | 144,516 | 2,132,600 | 3,133,352 | ||||||||||||

Richard P. Polizzotto | — | — | 100,598 | 81,562 | 2,974,164 | 1,703,931 | ||||||||||||||||||

Stephen C. Nelson | — | — | 38,221 | 76,031 | 1,168,426 | 1,714,919 | ||||||||||||||||||

Christopher W. Wilson | 15,187 | 492,317 | — | 61,031 | — | 1,401,737 | — | — | 18,983 | 78,562 | 605,522 | 1,783,408 | ||||||||||||

Executive Employment Agreements

In January 1999, the Company entered into an employment agreement with Manuel J. Perez de la Mesa, pursuant to which, the Company pays Mr. Perez de la Mesa an annual base salary currently set at $335,000,$350,000, to be reviewed annually by the Board, and an annual bonus in an amount determined by the Compensation Committee based on achievement of certain specified goals and objectives. Pursuant to the employment agreement, Mr. Perez de la Mesa also receives an allowance of up to $700 per month for the lease of an automobile of his choice. This vehicle allowance is presently set at $1,200 per month. Upon any termination of Mr. Perez de la Mesa’s employment by the Company other than for cause (as defined in the agreement), Mr. Perez de la Mesa is entitled to receive his base salary for a period of six months thereafter. The agreement also provides that Mr. Perez de la Mesa shall not compete with the Company for two years following the termination of his employment.

The Company also has employment agreements with the other Named Executive Officers, similar in nature to Mr. Perez de la Mesa’s, except that upon termination by the Company other than for cause (as defined in the agreement), the severance pay is for a period of up to three months and the non-compete is for one year following termination, and providing for currenttermination. The annual base salaries of $190,000, $190,000, $162,000 and $156,000,for the other Named Executive Officers are currently set at $200,000, $200,000, $170,000, $160,000, for Messrs. Cook, Murphy, Wilson and Polizzotto,Nelson, respectively.

Neither the Compensation Committee nor Audit Committee Report set forth below shall be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933 or under the Exchange Act, except to the extent that the Company specifically incorporates this information by reference, and neither shall be deemed filed under such acts.

REPORT OF THE COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS OF SCP POOL CORPORATION

The Compensation Committee of the Board of Directors, which is comprised solely of independent directors, administers all Company stock plans and reviews and makes recommendations to the Board regarding compensation and benefits of executive officers and certain other key employees of the Company. After consideration of the Compensation Committee’s recommendations, the entire Board reviews and approves the salaries, bonuses and benefit programs for the Company’s executive officers and certain other key employees. The Compensation Committee has the authority to engage the services of outside advisers, experts and others to assist it. In 2004, the Compensation Committee directly engaged an outside compensation consulting firm to assist the Compensation Committee in its review of the compensation for the executive officers. This consulting firm does not provide other consulting services to the Company.

910

Compensation Philosophy

The compensation philosophy of the Company is to link executive compensation to continuous improvements in corporate performance and increases in stockholder value. This philosophy applies to all employees, with a more significant level of variability and compensation at risk as an employee’s level of responsibility increases. The goals of the Company’s executive compensation program are as follows:

In 2004, the Compensation Committee directly engaged an outside compensation consultant to provide an independent analysis of the Company’s executive compensation program. The results of the analysis completed by this independent consultant, and corroborated by management and the Compensation Committee, included the following observations about the Company’s 2004 executive compensation:

Compensation Program Components

The Compensation Committee regularly reviews the Company’s executive compensation program to ensure that pay levels and incentive opportunities are competitive with similar positions in the market and reflect the performance of the Company. Each element of the compensation program for executive officers is further explained below.

Base Salary. The base salary levels for all executive officers are set based upon the officer’s level of responsibility, experience, past performance and the competitive market for executive talent.

Annual Incentive Bonus. The annual cash bonuses paid to the executive officers are paid according to formulas that are based almost entirely on objective performance criteria with a small component being discretionary. The objective performance measures used to calculate the bonus of Mr. Perez de la Mesa for 20032004 were earnings per share, return on total assets, cash flow from operations and organizational development. The objective portion of the bonuses of the other executive officers was based upon earnings per share and various other performance measures pertinent to the officer’s area of responsibility. The Company utilizes annual bonuses to focus corporate behavior on the achievement of goals for growth, financial performance and other specific annual objectives.

Stock OptionOptions.s. The Compensation Committee believes that the Company can closely align executive interests with the longer term interests of stockholders by encouraging equity participation in the Company. The Compensation Committee believes stock option awards promote the Company’s long-term performance goals and further executive retention. All management level employees are eligible to receive stock options. The individual option grant levels for all of the executive officers for 20032004 were based upon each respective officer’s level of responsibility. The stock options awarded to executive officers accounted for approximately 25% of the total number of stock options awarded in 2004.

Restricted Stock.In 2004, each named executive officer, with the exception of Mr. Perez de la Mesa, and certain other key employees were awarded restricted stock under the Company’s 2002 Long-Term Incentive Plan. Such restricted stock, which was granted in lieu of one-third of the respective employee stock options, vests in full on February 9, 2009 (subject to certain limitations).

Employee Stock Purchase Plan. Our employees can also acquire Company stock through a tax-qualified employee stock purchase plan, which is generally available to all employees. This plan allows participants to buy up to $25,000 of Company stock per year at a 15% discount to the market price (subject to certain limitations), with the objective of allowing employees to profit when the value of the Company’s stock increases over time.

11

Retirement and Savings Plans.For 2004, the Company’s 401(k) Plan provided a discretionary Company matching contribution, subject to certain limitations, of 50% of a participant’s deferrals of up to 6%. The Company also provided a profit-sharing plan whereby, at the discretion of the Board of Directors, a profit sharing contribution could be made annually to all eligible employees. In February, 2005, the Company’s Board of Directors eliminated the profit-sharing plan and increased the discretionary Company matching contribution under the 401(k) Plan to 50% of a participant’s deferrals of up to 8% of the lesser of (i) such participant’s salary and bonus or (ii) the Internal Revenue Code Section 401(a)(17) dollar limit for the applicable year. In February, 2005, the Company’s Board of Directors also authorized the adoption of a nonqualified deferred compensation plan (the “POOLCORP Deferred Compensation Plan”), which allows certain employees who occupy certain key management positions to defer salary and bonus. The POOLCORP Deferred Compensation Plan provides a matching contribution similar to that provided under the 401(k) Plan to the extent that a participant’s contributions to the 401(k) Plan are limited by IRS non-discrimination limitations. The total Company matching contribution provided to a participant under the 401(k) Plan and the POOLCORP Deferred Compensation Plan combined for any one year shall not exceed 4% of a participant’s salary and bonus.

Setting Executive Compensation

In setting the annual compensation for each executive officer, the Compensation Committee reviews executive compensation information derived from publicly available information.

The Compensation Committee further reviews the executive officer compensation levels for internal pay equity within the Company. The Compensation Committee also reviews the total remuneration that each executive officer could potentially receive if certain events occur, including a change in control, retirement, termination (for cause and without), and continuation of employment. Total remuneration includes total cash compensation, the future value of stock options and restricted stock and the dollar value to the executive and cost to the Company of all perquisites and other personal benefits.

Stock options granted to executive officers shall, subject to certain limitations, (1) immediately vest and become fully exercisable upon a change of control, death or disability; (2) remain exercisable and continue to vest in accordance with their original schedule upon retirement (which is defined as attainment of the age of 55 years or more and continuous service to the Company for a period of at least ten years); (3) be immediately forfeited, whether or not then exercisable, upon termination for cause; and (4) remain exercisable and, subject to Company discretion, continue to vest in accordance with their original schedule upon termination without cause. Restricted stock granted to executive officers shall, subject to certain limitations, (1) fully vest upon a change of control, death, or disability; (2) continue to vest in accordance with the original vesting schedule upon retirement; and (3) be immediately forfeited upon termination, whether voluntary or involuntary. Upon termination other than for cause, Mr. Perez de la Mesa is entitled to receive his base salary for a period of six months thereafter and the other executive officers are entitled to receive their respective base salary for a period of up to three months. Executive officers are not entitled to any additional compensation, perquisites or other personal benefits upon a change in control, retirement or termination.

Based on this review, the Compensation Committee finds total compensation for all executive officers (and, in the case of the severance and change-in-control scenarios, the potential payouts) in the aggregate to be reasonable and consistent with the market.

Certain Tax Considerations

Section 162(m) of the Internal Revenue Code (the “Code”(“Section 162(m)”) limits the deductibility by the Companygenerally disallows a tax deduction to public companies for compensation in excess of annual compensation over $1.0 million paid to a company’s chief executive officer or any of the Named Executive Officers, unlessfour other most highly compensated officers. Performance-based compensation that meets certain requirements under Section 162(m) is not subject to the compensation is “performance-based.”deduction limitation. The Company’s policy with respect to Section 162(m) is to make reasonable efforts to ensure that compensation is deductible without limiting the Company’s ability to attract and retain qualified executives. The Compensation Committee has not adopted a policy that all compensation must be deductible.

Management believes that the only executive compensation that presently meets the performance-based compensation requirements under Section 162(m) is stock options awarded under the Company’s 2002 Long-Term Incentive Plan (“2002 LTIP”). While the 2002 LTIP was designed to qualify as deductible compensation, the Compensation Committee believes that it is not in the stockholders’ interest to restrict the Compensation Committee’s discretion and flexibility in developing appropriate compensation programs and, in some instances, the Compensation Committee may approve compensation that is not fully deductible. Management estimates that a portion of the deduction for Manuel J. Perez de la Mesa’s 2004 compensation will be limited under Section 162(m).

12

Summary

After its review of all existing programs, the Compensation Committee believes that the total compensation program for executives of the Company is focused on increasing value for stockholders and enhancing corporate performance. The Compensation Committee currently believes that a significant portion of compensation of executive officers is properly tied to stock appreciation through stock options orand restricted stock ownership.grants. The Compensation Committee believes that executive compensation levels at the Company are extremely competitive with the compensation programs provided by other corporations with which the Company competes for executive talent.

COMPENSATION COMMITTEE

Andrew W. Code, Chairman

James J. GaffneyGeorge T. Haymaker, Jr.

Robert C. Sledd

10

Compensation Committee Interlocks and Insider Participation

During the last fiscal year, none of the members of the Compensation Committee were officers or employees of the Company or any of its subsidiaries. No executive officer of the Company served in the last fiscal year as a director or member of the board of directors or compensation committee of another entity, one of whose executive officers served as a director or member of the Board or Compensation Committee of the Company.

REPORT OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS OF SCP POOL CORPORATION

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements and the reporting process, including the system ofCompany’s internal controls.controls over financial reporting.

In this context, the Audit Committee has met and held discussions with management and the Company’s internal and independent auditors. Management represented to the Audit Committee that the Company’s audited financial statements were prepared in accordance with generally accepted accounting principles. The Audit Committee has reviewed and discussed the audited financial statements with management and the independent auditors. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended.

In addition, the Audit Committee has discussed with the independent auditors the auditor’s independence from the Company and management, including the matters in the written disclosures provided by the independent auditors to the Audit Committee as required by the Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees.

The Audit Committee has discussed with the Company’s internal and independent auditors the overall scope and plans for their respective audits. The Audit Committee has met with the internal and independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reporting. The Audit Committee has determined that the rendering of all non-audit services by the Company’s independent auditors is compatible with maintaining the auditor’s independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003,2004, for filing with the SEC. The Committee has also approved, subject to stockholder ratification, the selection of the Company’s independent auditors.

AUDIT COMMITTEE |

John E. Stokely, Chairman |

James J. Gaffney |

Harlan F. Seymour |

Robert C. Sledd |

1113

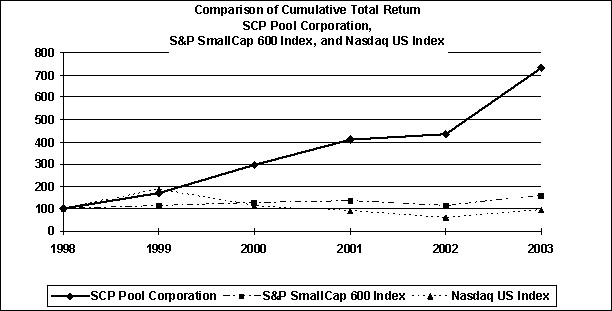

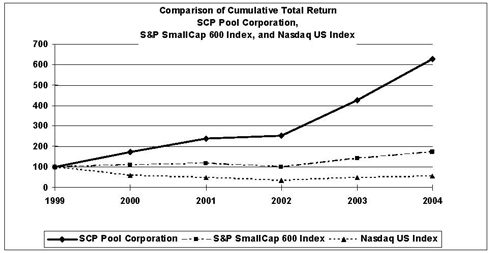

PERFORMANCE GRAPH

The graph below compares the total stockholder return on the Company’s Common Stock for the last five fiscal years with the total return on the Nasdaq US Index and the S&P SmallCap 600 Index for the same period, in each case assuming the investment of $100 on December 31, 19981999 and the reinvestment of all dividends. The Company has chosen the S&P SmallCap 600 Index for comparison because the Company does not believe that it can reasonably identify a peer group or a published industry or line-of-business index that contains companies in a similar line of business and because the S&P SmallCap 600 Index includes companies of similar capitalization to the Company.

| Total Return | Base Period | INDEXED RETURNS | ||||||||||||||||||||||||||||

| 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | Years Ending | ||||||||||||||||||||||||

Company / Index | 12/31/99 | 12/31/00 | 12/31/01 | 12/31/02 | 12/31/03 | 12/31/04 | ||||||||||||||||||||||||

SCP Pool Corporation | $ | 100 | $ | 171 | $ | 298 | $ | 408 | $ | 434 | $ | 729 | 100 | 173.86 | 238.12 | 253.30 | 425.23 | 627.04 | ||||||||||||

S&P SmallCap 600 Index | 100 | 112 | 126 | 134 | 114 | 159 | 100 | 111.80 | 119.11 | 101.68 | 141.13 | 173.09 | ||||||||||||||||||

Nasdaq US Index | 100 | 185 | 112 | 89 | 61 | 92 | 100 | 60.31 | 47.84 | 33.07 | 49.45 | 53.81 | ||||||||||||||||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In October 1999, the Company entered into a lease agreement with S&C Development, L.L.C., for a service center in Mandeville, Louisiana. The sole member of S&C Development, L.L.C., is A. David Cook, an SCPa Company executive officer. The seven year lease term commenced on January 1, 2000, and provides for rental payments of $6,510 per month. In January 2002, the Company entered into a lease agreement with S&C Development, L.L.C., for additional warehouse space adjacent to the Mandeville service center. The five year lease term commenced on February 4, 2002, and provides for rental payments of $4,123 per month. The total $10,633 monthly lease payment is for both facilities consisting of 21,100 square feet.

In January 2001, the Company entered into a lease agreement with S&C Development, L.L.C., for a service center in Oklahoma City, Oklahoma. The ten year lease term commenced on November 10, 2001, and provides for rental payments of $12,371 per month for the 25,000 square foot facility.

In March 1997, the Company entered into a lease agreement with Kenneth St. Romain for a service center in Baton Rouge, Louisiana. Kenneth St. Romain is the son of Frank J. St. Romain, who was President and Chief Executive Officer of SCP until January 1999 and was a director of SCP until May 2003. In January 2002, the Company extended this lease for a second term of five years which commenced on March 1, 2002. The lease agreement provides for rental payments of $10,137 per month for the 23,500 square foot facility.

1214

In May 2001, the Company entered into a lease agreement with Kenneth St. Romain for a service center in Jackson, Mississippi. The seven year lease term commenced on November 16, 2001, and provides for rental payments of $8,566 per month for the 20,000 square foot facility.

The Company believes the leases discussed above reflect fair market rates.rates and terms that are as favorable to the Company as could be obtained with unrelated third parties.

In February 2002, the Board determined that the Company will no longer enter into additional leases or material transactions with related parties.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers and persons owning more than 10% of a registered class of the Company’s equity securities to file with the SEC reports of ownership and changes in ownership of the Company’s Common Stock. Directors, executive officers and greater than 10% stockholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of these reports furnished, management believes that the directors, executive officers and greater than 10% stockholders timely complied with these requirements with the exception of one Form 5 amendment for Wilson B. Sexton correcting an inadvertent overstatement of a gift and the following reports that were inadvertently filed late: one Form 4 reporting one option grant made to eachthe exercise and sale of Wilson B. Sexton, Manuel J. Perez de la Mesa, A. David Cook, John M. Murphy, Richard P. Polizzotto, Christopher W. Wilson, Steven C. Nelson, Andrew W. Code, James J. Gaffney, John E. Stokely,certain options of Robert C. Sledd, Craig K. Hubbard and Donald L. Meyer.

PROPOSAL TO AMEND THE RESTATED CERTIFICATE OF INCORPORATION TO

INCREASE AUTHORIZED SHARES

(Proposal 2)

In February 2004, the Board of Directors approved, subjectwhich was filed one day late due to stockholder approval, an amendment to the Company’s Restated Certificate of Incorporation increasing the number of authorized shares of Common Stock from 40,000,000 to 100,000,000, and recommends its approval by the stockholders (the “Common Stock Amendment”). The text of the Common Stock Amendment is attached hereto as Appendix D and is incorporated by reference.

The Company is presently authorized to issue 40,000,000 shares of Common Stock. As of March 12, 2004, there were 35,501,829 shares of Common Stock issued and outstanding and 192,017 shares of Common Stock reserved for issuance under the Company’s stock option plans. The additional Common Stock proposed to be authorized by adoption of the Common Stock Amendment would have rights identical to the currently outstanding Common Stock of the Company. If the Common Stock Amendment is adopted, it will become effective upon filing of the Certificate of Amendment with the Secretary of State of the State of Delaware.

The Board recommends that the Common Stock Amendment be adopted because it believes that the number of shares of Common Stock available for issuance does not provide the Company with adequate flexibility to meet future business opportunities, including possible stock splits or other transactions, and opportunities to raise additional equity capital, to finance acquisitions and to issue additional capital stock in connection with current or future employee benefit plans. Given the limited number of shares currently available for issuance, the Company may not be able in the future to effect certain of these transactions without obtaining stockholder approval for an increase in the number of authorized shares of Common Stock. The cost, prior notice requirements and delay involved in obtaining stockholder approval at the time that corporate action may become desirable could eliminate the opportunity to effect the action or reduce the anticipated benefits.

The additional shares of Common Stock proposed to be authorized, together with existing authorized and unissued shares, generally will be available for issuance without any requirement for further stockholder approval, unless stockholder action is required by applicable law or by the rules of Nasdaq or of any stock exchange on which the Company’s securities may then be listed. Although the Board will authorize the issuance of additional shares only when it considers doing so to be in the best interest of stockholders, the issuance of additional shares of Common Stock may, among other things, have a dilutive effect on earnings per share of the Common Stock and on the voting rights of holders of shares of Common Stock. The Company’s stockholders do not have any preemptive rights to subscribe for additional shares of Common Stock that may be issued. In addition, although the Board has no current plans to do so, shares of Common Stock could be issued in various other transactions that would make a change in control of the Company more difficult or costly and therefore, less likely. For example, shares of Common Stock could be sold to support the Board in a control contest or to dilute the voting or other rights of a person seeking to obtain control.

13

The proposed Common Stock Amendment is not the result of any specific effort to obtain control of the Company by a tender offer, proxy contest, or otherwise, and the Company has no present intention to use the increased shares of authorized Common Stock for anti-takeover purposes. An affirmative vote of the holders of a majority of the shares of Common Stock outstanding is required for approval of the Common Stock Amendment.

The Board of Directors unanimously recommends that the stockholders vote “FOR” the approval of the amendment to the Company’s Amended Certificate of Incorporation to increase the number of authorized shares of the Company’s Common Stock from 40,000,000 to 100,000,000.

PROPOSAL TO AMEND THE 2002 LTIP TO

INCREASE THE MAXIMUM NUMBER OF SHARES AUTHORIZED FOR ISSUANCE

(Proposal 3)

In February 2004, the Board of Directors approved, subject to stockholder approval, an amendment to the Company’s 2002 LTIP to increase the maximum number of shares of Common Stock authorized for issuance under the 2002 LTIP from 1,050,000 to 1,800,000 shares, and recommends its approval by the stockholders (the “2002 LTIP Amendment”). The text of the proposed 2002 LTIP Amendment is attached hereto as Appendix E and is incorporated by reference.

Stockholders are requested in this Proposal 3 to approve the increase in the maximum number of shares authorized for issuance under the 2002 LTIP. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Meeting will be required to approve the 2002 LTIP Amendment.

The Board believes that the growth of the Company depends upon the efforts of its officers and key employees and that the 2002 LTIP provides an effective means of attracting and retaining qualified key personnel while enhancing their long-term focus on maximizing stockholder value. As of February 20, 2004, 1,017,750 shares had been issued under the 2002 LTIP, including 33,600 shares of restricted stock that vest in February 2009, and options to purchase an aggregate of 984,150 shares at exercise prices ranging from $17.71 to $32.50 with a weighted average exercise price of $23.18 per share were outstanding. Excluding the increase of 750,000 shares for which stockholder approval is being sought pursuant to this Proposal 3, 32,250 shares (plus any shares that might in the future be returned to the 2002 LTIP as a result of cancellations or expiration of options) remain available for future grant under the 2002 LTIP. The Board believes that adoption of the 2002 LTIP Amendment is necessary to provide the Company with the continued ability to attract, retain, and motivate key personnel in a manner that is tied to the interests of the stockholders.

The essential features of the 2002 LTIP are outlined below:

Administration of the 2002 LTIP.The Compensation Committee of the Board administers the 2002 LTIP and has authority to make awards under the 2002 LTIP, to set the terms of the awards, to interpret the 2002 LTIP, to establish any rules or regulations relating to the 2002 LTIP that it determines to be appropriate and to make any other determination that it believes necessary or advisable for the proper administration of the 2002 LTIP. Subject to the limitations specified in the 2002 LTIP, the Compensation Committee may delegate its authority to appropriate personnel of the Company.

Eligibility.Officers and key employees of the Company (including officers who are also directors of the Company) are eligible to receive awards (“Incentives”) under the 2002 LTIP when designated as plan participants. The Company currently has approximately eight officers and 400 key employees eligible to receive Incentives under the 2002 LTIP. Over the past couple of years, the Company has granted awards to all of its officers and substantially all of its key employees under the predecessor plans. The 2002 LTIP also permits consultants and advisers to receive Incentives, although neither the Company nor the Compensation Committee has awarded, nor currently has the intention to award, Incentives to consultants or advisers. Incentives under the 2002 LTIP may be granted in any one or a combination of the following forms:

Incentives relating to no more than 200,000 shares of Common Stock may be granted to a single participant in one calendar year. No more than 50,000 shares may be issued as restricted stock.

14

Shares Issuable through the 2002 LTIP.If stockholders approve the 2002 LTIP Amendment, a total of 1,800,000 shares will be reserved for issuance under the 2002 LTIP, representing an increase of 750,000 shares.

For purposes of determining the maximum number of shares of Common Stock available for delivery under the 2002 LTIP, shares that are not delivered because of a net share exercise, as defined in the 2002 LTIP, or because the Incentive is forfeited, canceled or reacquired by the Company and shares that are withheld to satisfy participants’ applicable tax withholding obligations or payment of the option exercise price will not be deemed to have been delivered under the 2002 LTIP. Also, if the exercise price of any stock option granted under the 2002 LTIP or any tax withholding obligation is satisfied by tendering shares of Common Stock, only the number of shares issued net of the shares tendered will be deemed delivered for purposes of determining the maximum number of shares of Common Stock available for delivery under the 2002 LTIP. If stockholders approve the increase in the maximum number of shares authorized for issuance under the 2002 LTIP pursuant to this Proposal 3, no more than 1,800,000 shares may be delivered upon exercise of stock options intended to qualify as incentive stock options under Section 422 of the Code, and shares withheld or delivered to cover taxes or the payment of the exercise price for incentive stock options will not be credited against this 1,800,000 share limit applicable to incentive stock options.

Proportionate adjustments will be made to all of the share limitations provided in the 2002 LTIP, including shares subject to outstanding Incentives, in the event of any recapitalization, reclassification, stock dividend, stock split, combination of shares or other change in the Common Stock, and the terms of any Incentive will be adjusted to the extent appropriate to provide participants with the same relative rights before and after the occurrence of any such event.

Amendments to and Termination of the 2002 LTIP. The Board may amend or discontinue the 2002 LTIP at any time. However, the stockholders must approve any amendment that would:

No amendment or discontinuance of the 2002 LTIP may materially impair any previously granted Incentive without the consent of the recipient.

Types of Incentives. Each of the types of Incentives that may be granted under the 2002 LTIP is described below:

Stock Options. The Compensation Committee may grant non-qualified stock options or incentive stock options to purchase shares of Common Stock. The Compensation Committee will determine the number and exercise price of the options, provided that the option exercise price may not be less than the fair market value of a share of Common Stock on the date of grant. The term of an option will also be determined by the Compensation Committee, but may not exceed 10 years. The majority of the underlying incentive agreements for the options granted under the 2002 LTIP provide that for those employees that have been employed by the Company for at least five years on the date of grant, their options vest in one-half increments in three and five years and for those employees that have been employed by the Company for less than five years on the date of grant, their options vest in five years. In February 2004, the Board amended the 2002 LTIP to provide that the time or times that the options become exercisable shall be determined by the Compensation Committee; provided, however, except in such cases as death, disability, change of control or as otherwise provided in an underlying incentive agreement entered into in compliance with the 2002 LTIP prior to February 10, 2004, no more than 24,000 stock options with a vesting period of one year or less shall be granted under the 2002 LTIP and each other stock option granted under the 2002 LTIP shall become vested and exercisable no earlier than three years from the date of grant. The Compensation Committee may also approve the purchase by the Company of an unexercised stock option from the optionee by mutual agreement for the difference between the exercise price and the fair market value of the shares covered by the option.

Except for adjustments permitted in the 2002 LTIP to protect against dilution, without approval of the stockholders, the exercise price of an outstanding option may not be decreased after grant, nor may an option that has an exercise price that is greater than the then current fair market value of a share of Common Stock be surrendered to the Company as consideration for the grant of a new option with a lower price or other substitute award.

15

The option exercise price may be paid:

Incentive stock options will be subject to certain additional requirements necessary in order to qualify as incentive stock options under Section 422 of the Code.

Restricted Stock. Shares of Common Stock may be granted by the Compensation Committee to an eligible participant and made subject to restrictions on sale, pledge or other transfer by the participant for a certain period (the “Restricted Period”). Except for shares of restricted stock that vest based on the attainment of performance goals, the Restricted Period must be a minimum of three years with incremental vesting of portions of the award over the three-year period permitted. If vesting of the shares is subject to the attainment of specified performance goals, a minimum Restricted Period of one year with incremental vesting is allowed. All shares of restricted stock are subject to such restrictions as the Compensation Committee may provide in an agreement with the participant, including provisions obligating the participant to forfeit or resell the shares to the Company in the event of termination of employment or if specified performance goals or targets are not met. Subject to the restrictions provided in the agreement and the 2002 LTIP, a participant receiving restricted stock will have all of the rights of a stockholder as to such shares.

Performance-Based Compensation under Section 162(m).Stock options granted in accordance with the terms of the 2002 LTIP qualify as performance-based compensation under Section 162(m) of the Code and as a result are not subject to the deduction limitations of Section 162(m). Grants of restricted stock that the Company intends to qualify as performance-based compensation under Section 162(m) must be made subject to the achievement of pre-established performance goals. The pre-established performance goals are to be based upon any or a combination of the following business criteria: earnings per share, return on assets, an economic value added measure, stockholder return, earnings, stock price, return on equity, return on total capital, reduction of expenses, or increase in revenues, cash flow or customers of the Company, or one or more operating divisions or subsidiaries. For any performance period, the performance goals may be measured on an absolute basis or relative to a group of peer companies selected by the Compensation Committee, relative to internal goals, or relative to levels attained in prior years.

The Compensation Committee has authority to use different targets from time to time under the performance goals provided in the 2002 LTIP. As a result, the regulations under Section 162(m) require that the material terms of the performance goals be reapproved by the stockholders every five years. To qualify as performance-based compensation, grants of restricted stock are required to satisfy the other applicable requirements of Section 162(m).

Termination of Employment.If an employee participant ceases to be an employee of the Company for any reason, including death, his outstanding Incentives may be exercised or will expire at such time or times as may be determined by the Compensation Committee and described in the incentive agreement.